Transition MT MX

“DEVLHON Consulting experts

assist banks in optimizing AML/CFT controls of SWIFT messages in MX format, starting today, in close collaboration with Compliance and Business teams.”

THE CHALLENGES

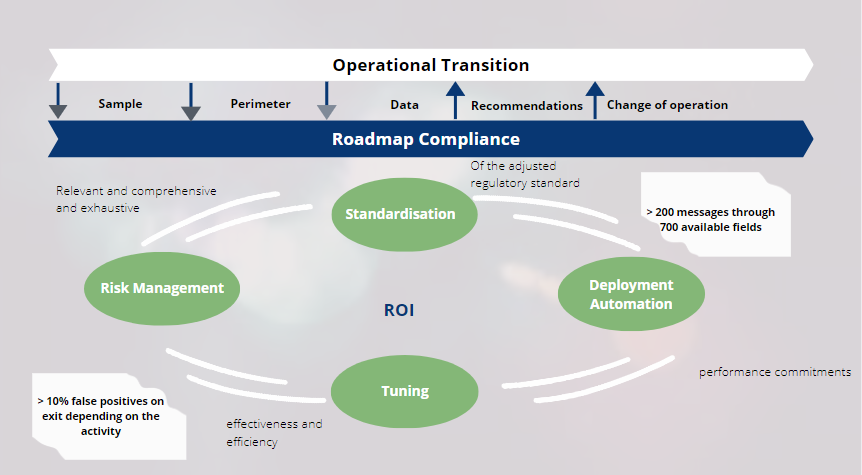

The migration of MT messages for non-EU payments to the new MX formats is changing the fraud scenarios, modifying the risks and requiring banks to adapt their AML and filtering processes. This evolution is not only technical, it also includes functional and business issues!

In addition to the need to comply with it, the MT/MX coexistence phase until 2025 must be a lever of operational efficiency for the Business Units and the Compliance function. Built on a new metadata repository, the senders and receivers of these financial flows have a key role to play in standardization to ensure relevant control and good quality of customer service.

Minimizing risks and reducing false alarms are the major challenges of this evolution. It will be necessary to guard against the risks of data loss, confusion, misinterpretation and inconsistency of filtering rules or AML scenarios.

The transition to MX under ISO 20022 is a great lever for the industrialization of compliance through the rationalization of alert management and more relevant exploitation of data in a “SMART DATA” approach for the actors of the lines of defense (LoDs) 1 and 2 or even sales.

MATURITY @ISO 20022

- Audit of message filtering and monitoring tools, rules and processes

- Risk Assessment and migration strategy recommendations

DATA CATALOG : TO CONTROL MX RISKS

- Preparation of the internal catalog based on the metadata repository

- Classification of fields, objects and their business attributes according to their formats, constraints…

- Evolution of the existing methodology (filtering matrix, AML scenarios, rules and exceptions)

- Evaluation and mapping of identified risks

ROI-TUNING AND AUDITABILITY (FILTERING AND/OR AML)

- Implementation of tools and method of blank audit

- From the implemented catalog (prerequisite), reading control in IT proprietary format and restitution of filtering engines

- Test on real data and analysis of the relevance of alerts (by message, sequence / field, fraud scenarios, …)

- Analysis of the impact on the output of the tools and on the level 1 and 2 processing of alerts (false positives, quality of alerts, case management, etc.)

- Optimization of alert management (noise reduction)

- Quality assurance plan in a logic of ROI of the implementation and iterative upgrade of the catalog

- Support in the optimization and adaptation of the reporting system

- Change management / Training for a synergistic operation of the Front/Back – Compliance chain

- Implementation of the necessary documentation

SUCCESS STORIES

Français

Français