Correspondent Banking AML

“Our firm’s consultants act on AML projects in Correspondent Banking for the account of many international banking groups”

During these missions, they help the compliance project teams to the quick establishment of solutions, by using many processes and technologies.

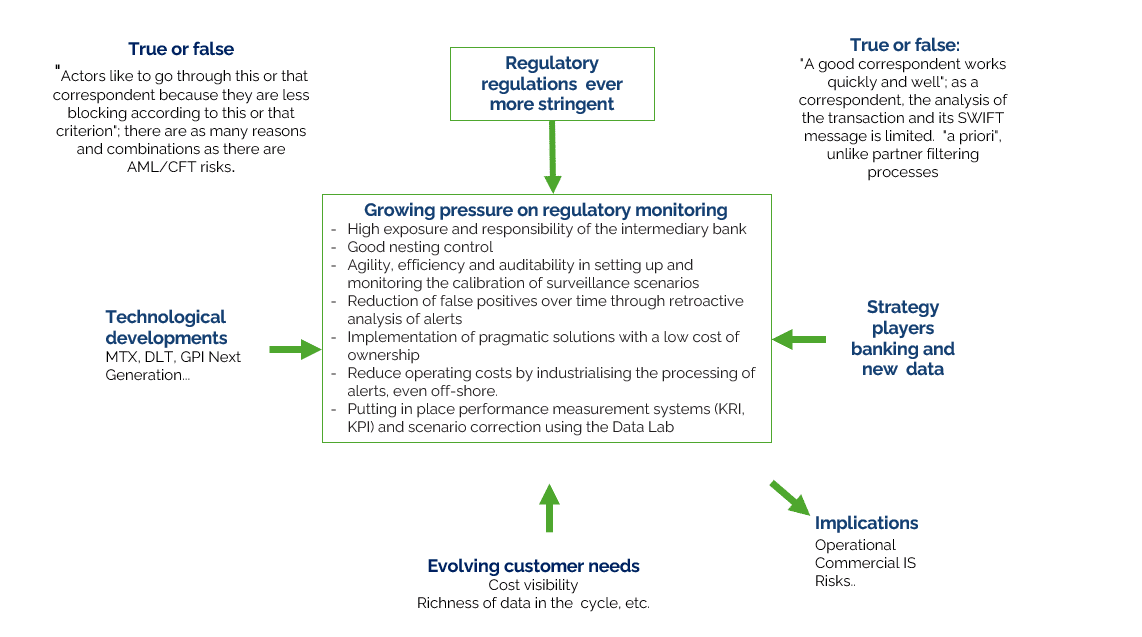

THE STAKES

Correspondent banking is considered, by regulators, as a high risk activity because of its exposure to money laundering. Like all operations managed by banking institution, monitoring bank correspondence transactions is a regulatory requirement, most of the time transcript in the bank instructions and which must be integrated in the program of devices and transactions surveillance tools transformation.

THE OFFERS

OFFER COMPLETE UPDATE CB AML

- Framing of the bank correspondence AML surveillance program/span>

- Identification of risks

- Classification of risks

- Definition of the target to answer properly to the risks

- Complete functional, technical and organizational implementation

- Testing of the organization and processes for monitoring and optimum reporting

- Change management

- Evaluation after 6 months (optional)

OFFER TUNING CB AML

- Adjustment of risk responses by defining all the scenarios responding to the identified risks, among other things to reduce the number of false positives

- Calibration of these scenarios according to the local specificities

- Assistance in choosing and/or adapting existing tools

- Fine-tuning of the organization and of the monitoring and optimum reporting processes

OFFER AUDITABILITY CB AML

- Implementation of regulatory documentation and auditability tools

- Definition of the organization and processes to respond to flash risks and audits

- Preparation by “dummy audit” method

- Monitoring of tool/scenario and method developments

- Support in the optimization and quality of the reporting system

- Cross refund at 3 months (optional)

Français

Français