Trade Finance LCB-FT

“Our experts are involved in AML projects in TRADE FINANCE activity on behalf of various international banking groups.”

During these projects, they help compliance project teams on the rapid implementation of concrete solutions, by transforming processes and technologies on regulatory aspects as well as the efficiency of their operational model.

YOUR CHALLENGES

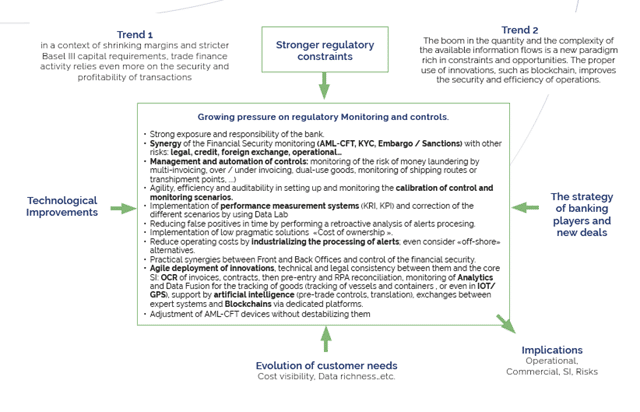

Trade Finance is considered to be a high-risk activity as it is very exposed to money laundering practices. Regulators, whether European, American or Asian, are increasing requirements.

As for all banking operations, the control and monitoring of trade finance transactions are a regulatory requirement, often stated in the bank’s instructions. This process must be integrated into the transformation programs of the transaction control and monitoring devices and tools (LoD1 and LoD2, first Line of Defense and second Line of Defense).

These are also costly areas in terms of time and expertise to mobilize, and complex ones, because of the crossroads of financial, documentary and logistical flows.

OFFER COMPLETE UPGRADE TF LCB-FT

- Flash framing of the LCB-FT control and monitoring program

- Identification of risks, prioritization of risks (update of the

of the mapping) - Definition of the target to respond proportionally to these risks,

- Complete functional, organizational and technical implementation (example: roles and responsibilities)

- Update of the procedural body

- Testing of the organization and processes of control and monitoring, and optimum reporting.

- Quality review of the control plans.

- Implementation of the control plans in the appropriate tools.

- Change management

- Review at 6 months (optional)

OFFER TUNING TF LCB-FT

- Adjustment of risk responses by defining the set of Control and Monitoring scenarios, responding to the identified risks, among others, to reduce the number of false positives.

- Operational Efficiency and immediate ROI (“Lean TF

AML”) of the processing, analysis and management of alerts and

controls - Calibration of Control and Monitoring scenarios, according to “local specificities”

- Assistance in the choice and/or adaptation of existing or future tools.

- Fine-tuning of the organization and the processes of Control and

Monitoring and reporting processes.

OFFER AUDITABILITY TF LCB-FT

- Implementation of regulatory documentation and audibility tools

audibility tools - Follow-up of the evolution of tools (core/specific/case

management), scenarios and methods - Definition of the organization and processes to respond to the risks.

- Preparation by the “Mock audit” method

- Support in the optimization and quality of the reporting system

- Cross-reporting at 3 months (optional)

Français

Français